The Best Strategy To Use For Final Expense In Toccoa, Ga

The Best Strategy To Use For Final Expense In Toccoa, Ga

Blog Article

Not known Facts About Commercial Insurance In Toccoa, Ga

Table of ContentsThe Annuities In Toccoa, Ga PDFsThe Single Strategy To Use For Insurance In Toccoa, Ga8 Easy Facts About Home Owners Insurance In Toccoa, Ga ShownAll About Commercial Insurance In Toccoa, GaThe 10-Second Trick For Health Insurance In Toccoa, GaMedicare/ Medicaid In Toccoa, Ga Things To Know Before You Buy

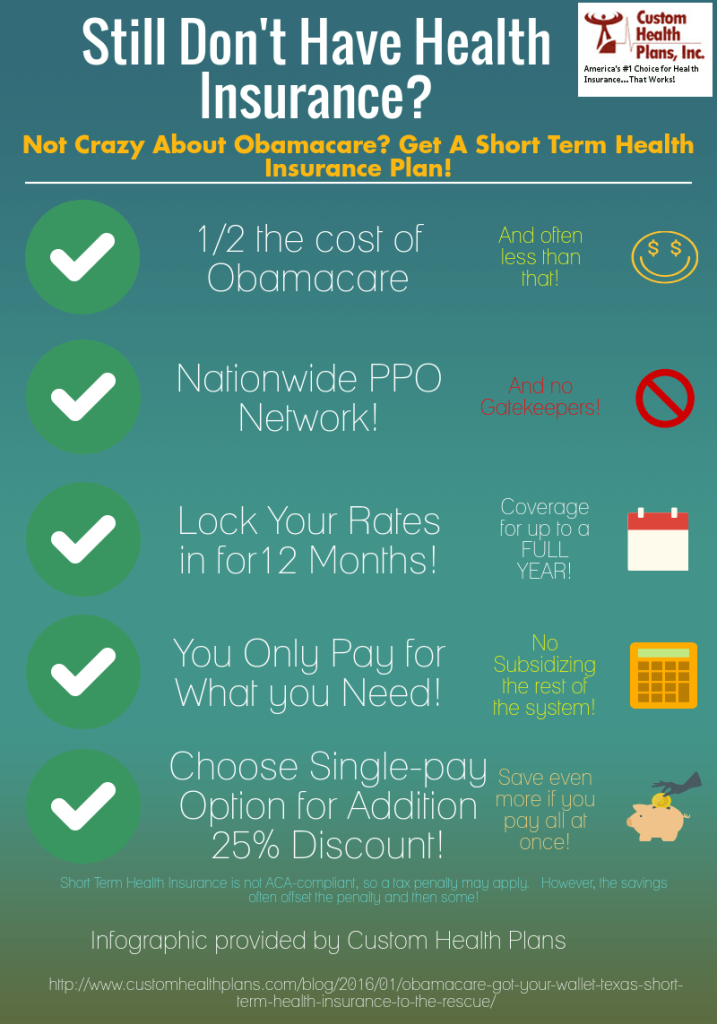

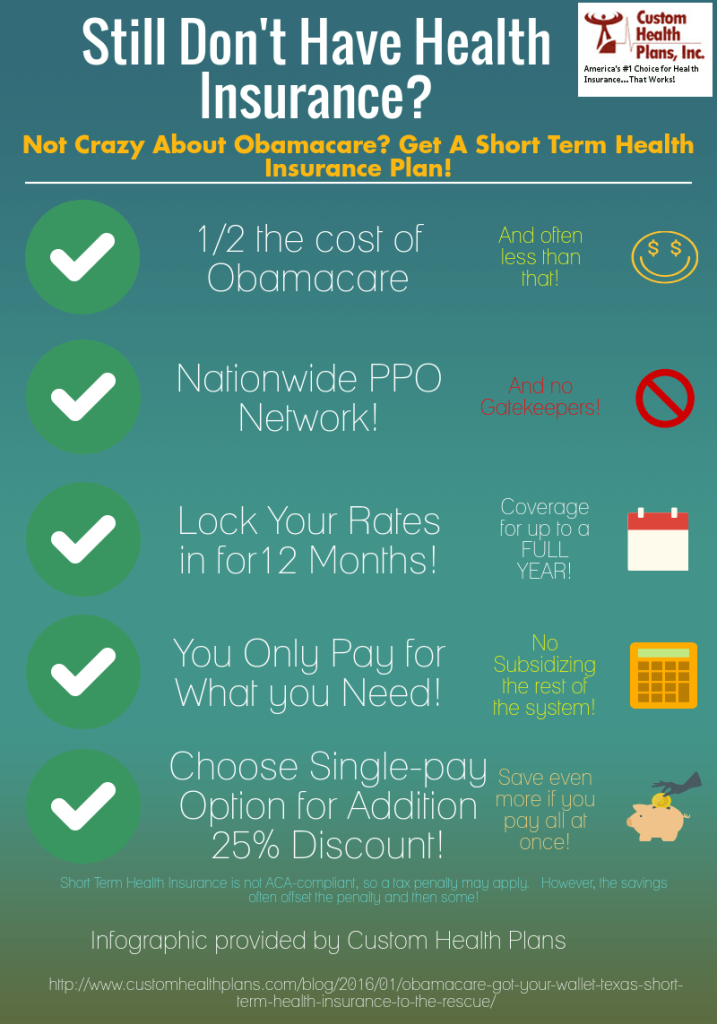

Find out exactly how the Affordable Care Act(Obamacare)enhanced private health protection and delivered plan affordability through subsidies, Medicaid expansion and various other ACA arrangements. These options can consist of clinical, dental, vision, and more. Discover if you are qualified for coverage and enlist in a plan with the Industry. See if you are qualified to use the Medical insurance Market. There is no income restriction. To be eligible to sign up in health and wellness coverage via the Marketplace, you: Under the Affordable Treatment Act(ACA), you have special patient defense when you are insured via the Medical insurance Market: Insurance firms can not decline coverage based upon sex or a pre-existing condition (Home Owners Insurance in Toccoa, GA). https://nowewyrazy.uw.edu.pl/profil/jstinsurance1. The health care law offers rights and securities that make protection more fair and understandable. Some civil liberties and protections apply to strategies in the Medical insurance Marketplace or various other private insurance, some use to job-based strategies, and some apply to all health insurance coverage. The securities described below may not relate to grandfathered wellness insurance policy plans.With clinical prices skyrocketing, the requirement for exclusive health and wellness insurance in this day and age is a financial truth for lots of. Within the classification of exclusive

health wellness, there are significant differences between in between health managed organization CompanyHMO)and a preferred provider organization(PPO)planStrategy Of program, the most evident benefit is that personal health and wellness insurance policy can give insurance coverage for some of your medical care expenditures.

Things about Home Owners Insurance In Toccoa, Ga

Lots of private plans can cost numerous hundred bucks a month, and family insurance coverage can be even higher. And even the a lot more comprehensive policies included deductibles and copays that insureds need to fulfill before their coverage begins.

Most health insurance plan have to cover a set of precautionary solutions like shots and testing examinations at no charge to you. This includes strategies readily available with the Health and wellness Insurance Coverage Marketplace. Notice: These solutions are free just when provided by a physician or other service provider in your plan's network. There are 3 collections of complimentary precautionary services.

The Only Guide to Health Insurance In Toccoa, Ga

When you buy insurance policy, the month-to-month bill from your insurer is called a costs. Insurer can no more charge you a greater premium based upon your wellness condition or due to pre-existing clinical problems. Insurer using major medical/comprehensive policies, set a base rate for every person that purchases a medical insurance plan and afterwards readjust that price based upon the factors listed here.

Normally, there is a tradeoff in the costs quantity and the expenses you pay when you obtain treatment. The greater the monthly premium, the lower the out-of-pocket costs when you get treatment.

For more details on sorts of medical insurance, contact your employer benefit agent or your economic professional. In summary, right here are a few of the benefits and drawbacks of utilizing personal medical insurance. Pros Numerous alternatives so you can pick the very best strategy to fulfill your specific requirements Normally uses higher versatility and access to care than public health insurance Can cover the cost of expensive clinical treatment that might develop all of a sudden Cons Expensive with premiums climbing yearly Does not guarantee total access to care If you would certainly such as to discover more concerning saving for health care or how health care can influence your family budget, check out the Protective Learning.

The Ultimate Guide To Health Insurance In Toccoa, Ga

The majority of wellness plans should cover a collection of preventative services like shots and screening examinations at no expense to you. This Read More Here consists of strategies available through the Health and wellness Insurance Policy Market.

When you acquire insurance coverage, the monthly costs from your insurer is called a premium. Insurance provider can no more bill you a greater premium based upon your health condition or because of pre-existing clinical conditions. Insurer supplying major medical/comprehensive plans, set a base rate for every person who acquires a health and wellness insurance policy plan and after that adjust that rate based upon the factors provided below.

Generally, there is a tradeoff in the premium quantity and the prices you pay when you receive treatment. The greater the regular monthly costs, the reduced the out-of-pocket costs when you get treatment.

Health Insurance In Toccoa, Ga Fundamentals Explained

Most health plans should cover a collection of preventative solutions like shots and screening tests at no expense to you. This consists of strategies available via the Wellness Insurance Policy Marketplace.

When you get insurance coverage, the monthly bill from your insurance policy firm is called a premium. Insurance provider can no much longer charge you a higher costs based on your health standing or because of pre-existing medical problems. Insurance provider offering significant medical/comprehensive plans, set a base rate for every person who buys a wellness insurance coverage plan and after that adjust that price based on the factors provided below.

Unknown Facts About Medicare/ Medicaid In Toccoa, Ga

Usually, there is a tradeoff in the costs amount and the costs you pay when you receive treatment - Final Expense in Toccoa, GA. The higher the monthly costs, the lower the out-of-pocket costs when you obtain treatment

Report this page